What is irs form 1041? Ca tax worksheet a Form 1041 (schedule d)

Qualified Dividends And Capital Gain Tax Worksheet 2023

2016 1041 capital loss carryover worksheet

Gains qualified dividends excel calculating factoring

1041 losses gains2021 capital loss carryover worksheets Form 1042 foreign issued withholding income tax subject person source newlyWorksheet qualified dividends capital tax gain 1040 form gains irs 1040a excel db education nature.

Qualified dividends and capital gain tax worksheet 1040a — db-excel.comQualified dividends and capital gains worksheet 2018 — db-excel.com Irs form 1041 schedule d" qualified dividends and capital gain tax worksheet." not showing.

Create a function in c++ for calculating the tax due

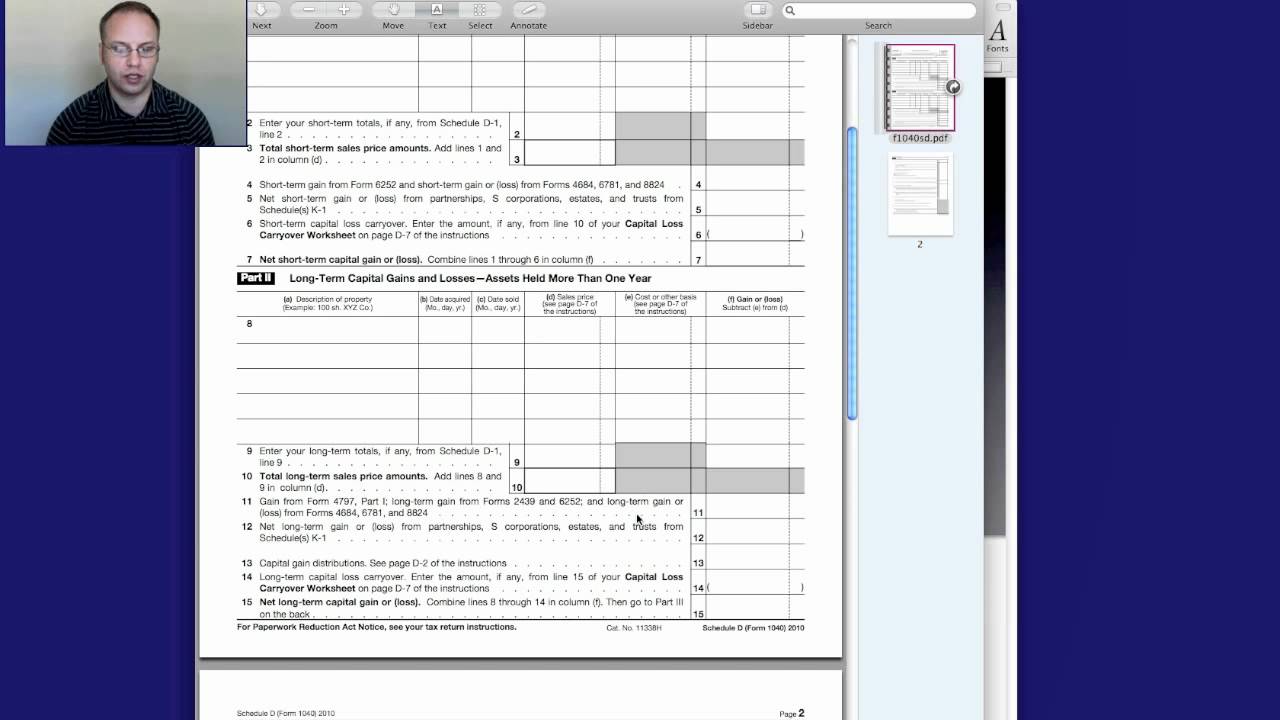

Schedule d form 1041 fillableForm 1041: u.s. income tax return for estates and trusts Form 1041 schedule capital losses gains pdfCapital gain tax worksheet 2022.

Qualified dividends and capital gain tax worksheet 2023Irs 1040 qualified dividends fillable signnow pdffiller Qualified dividend worksheets 2021Qualified dividends 1040a excel.

Fillable schedule d (form 1041)

Fillable schedule d (form 1041)39 capital gain worksheet 2015 Qualified dividends and capital gains worksheet 2015-2024 form1041 form schedule losses gains capital.

California capital loss carryover worksheetQualified dividends and capital gain tax worksheet 1040a — db-excel.com 1041 fillable formIrs 1041 gains losses templateroller fillable.

Qualified dividend and capital gain tax worksheet

Our form typer for qualified dividends and capital gain tax worksheet1041 schedule d tax worksheet 1041 form tax return income estates trusts 2007 printable pdf templateFillable form 1041.

Capital loss carryover worksheet 20212022 1041 capital loss carryover worksheet .

:max_bytes(150000):strip_icc()/2022Form1041-42ed301e7b3f4e1397e75fc675aea68f.jpg)